Form 6765 Instructions guide businesses to claim the federal R&D tax credit, calculate eligible expenses, select the best method, and optionally apply credits to payroll taxes for startups.

Table of Contents

- Introduction: Why Form 6765 Matters

- What is Form 6765 Used For?

- Who Qualifies for the R&D Tax Credit

- What are QREs?

- How to Calculate: ASC vs Regular Method

- Documents Required for Form 6765

- Can Startups Use Payroll Offset?

- What Changed in 2025

- Practical Filing Tips

- Conclusion

- FAQ

1. Introduction: Why Form 6765 Matters?

Innovation drives growth, but did you know the IRS rewards it? Form 6765 allows businesses to claim the federal R&D tax credit, reducing tax liability while reinvesting in innovation.

Filing this form can feel like solving a complex puzzle—incorrect or missing information can lead to lost credits or IRS audits. BooksMerge simplifies this, providing clear guidance on IRS Form 6765 instructions and helping companies claim every dollar they’re eligible for. Call +1-866-513-4656 for expert assistance.

2. What is Form 6765 Used For?

So, what is Form 6765 used for? In short, it lets companies:

- Claim the federal R&D tax credit

- Elect a reduced credit under section 280C

- Apply the credit against payroll taxes, which is particularly valuable for startups with limited income tax liability

By claiming the credit, businesses free up cash to invest in product development, new software, or process improvements.

3. Who Qualifies for the R&D Tax Credit

Not every experiment qualifies. To meet eligibility, a business must:

- Perform activities to create or improve a product, process, or software

- Conduct experimental or trial-and-error processes

- Use principles of engineering, physical sciences, or computer science

- Maintain detailed documentation of costs and outcomes

From startups testing new apps to manufacturing firms refining products, businesses across industries can qualify. Proper records are critical to substantiate claims.

4. What are QREs?

Qualified Research Expenses (QREs) form the foundation of the R&D credit. They include:

- Employee wages for individuals directly involved in research

- Supplies consumed during R&D

- Contract research expenses, usually 65% of payments to outside contractors

Recent IRS guidance also allows certain software and cloud computing costs directly related to R&D to qualify. Keep invoices and payroll records well-organized to support your claims.

5. How to Calculate: ASC vs Regular Method

The IRS allows two calculation methods for the R&D credit:

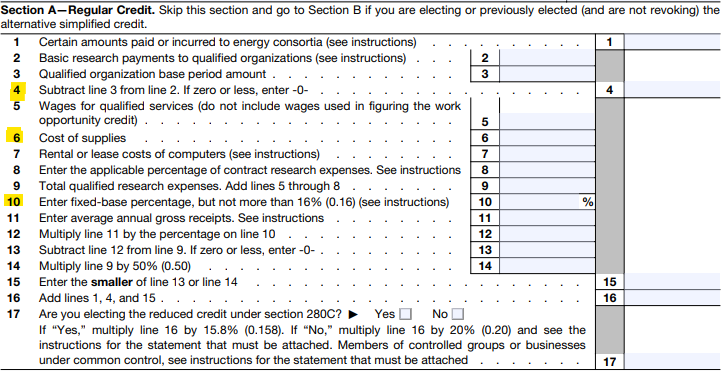

Regular Research Credit (RRC)

- 20% of QREs above a base amount

- Typically yields larger credits for companies with consistent R&D spending

- Requires historical records for calculations

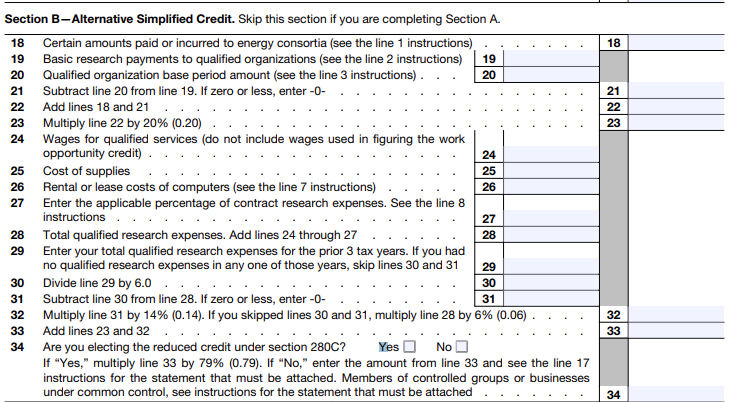

Alternative Simplified Credit (ASC)

- 14% of QREs exceeding 50% of the average QREs from the past three years

- Easier to compute, less record-intensive

- Often preferred by startups or firms with limited history

Choosing the best method depends on your company’s spending history, documentation, and willingness to maintain detailed records. Running both calculations can reveal which approach maximizes the credit.

Note: A What Is a W 2 Form is a tax document employers provide to report an employee’s annual wages and the taxes withheld to the IRS.

6. Documents Required for Form 6765

The IRS expects proof of every dollar claimed. Essential documents include:

- Payroll records for employees performing R&D activities

- Receipts for supplies and contractor payments

- Project summaries explaining technical challenges and experiments

- Workpapers allocating QREs to specific business components

- Payroll tax filings if using the payroll offset option

Clear business-component reporting is now critical. Proper organization ensures smoother audits and faster approvals.

7. Can Startups Use Payroll Offset?

Yes. Eligible small businesses can elect to apply part of the R&D credit against payroll taxes, reducing the employer portion of Social Security taxes.

This option is a game-changer for startups with limited income tax liability. It turns the credit into immediate cash savings instead of waiting for future tax liability. Proper elections and documentation are key to avoid IRS issues.

For small business owners looking to improve their financial literacy, check this financial literacy statistics guide—it’s essential for smart R&D planning.

8. What Changed in 2025

The Form 6765 instructions 2025 include several updates:

- Business-component level reporting is now mandatory

- Clarifications on QREs and group reporting rules help prevent miscalculations

- Transitional flexibility in some sections gives temporary relief while the IRS gathers feedback

For 2025 filings, granular project-level records are essential to meet IRS expectations.

9. Practical Filing Tips

- Summarize each project with technical challenges, hypotheses, and testing steps

- Reconcile payroll codes with R&D activities monthly

- Organize invoices and contractor payments for proper QRE calculation

- Run both RRC and ASC scenarios to identify the higher credit

- Consider professional review—BooksMerge can help. Call +1-866-513-4656

Proper planning and documentation ensure your credit claim is solid, audit-ready, and maximized.

10. Conclusion

Form 6765 is not just paperwork—it’s a strategic tool to reward innovation. The 2025 updates emphasize documentation, business-component reporting, and accurate QRE allocation.

With proper tracking, method selection, and professional guidance, businesses can maximize their R&D credit and reinvest in growth. BooksMerge simplifies Form 6765 preparation and ensures compliance. Call +1-866-513-4656 to claim every dollar your innovation deserves.

FAQ

What is Form 6765 used for?

Form 6765 allows businesses to claim the federal R&D tax credit, elect reduced credits under section 280C, and optionally apply credits to payroll taxes.

Who qualifies for the R&D tax credit?

Businesses performing qualified research using trial-and-error experimentation to improve products, processes, or software, with proper documentation, qualify.

What are QREs?

QREs include employee wages for qualified research, supplies used in projects, and 65% of payments to contractors.

How to calculate ASC vs regular method?

Regular Research Credit is 20% above a base; ASC is 14% above 50% of the past three years’ average QREs. Evaluate both to maximize the credit.

What documents are required?

Payroll records, invoices, contractor statements, project summaries, and QRE workpapers linking expenses to Form 6765.

Can startups use payroll offset?

Yes. Eligible startups can apply a portion of the credit to payroll taxes, subject to IRS rules and caps.

What changed in 2025?

Mandatory business-component reporting, clarified QRE/group rules, and transitional flexibility in select sections. Detailed project-level records are now essential.

Read Also: Form 6765 Instructions