IRS Form 6765 instructions guide businesses on how to claim the research and development tax credit correctly and maximize their credit benefits under current U.S. tax law.

Welcome to a clear, friendly explanation of IRS Form 6765 Instructions!

At BooksMerge, we help businesses make complex tax forms understandable and actionable. In this article you will learn how to follow instructions for Form 6765, understand key terms like QREs and ASC, and prepare your paperwork the smart way. If you ever need help, call +1‑866‑513‑4656 and let our experts assist you.

Table of Contents

- What is IRS Form 6765

- Why Form 6765 Matters

- Who Qualifies for R D Tax Credit

- Key Terms Explained

- Qualified Research Expenses (QREs)

- Alternative Simplified Credit (ASC) vs Regular Credit

5.Step‑by‑Step: Instructions for Form 6765

6.Required Documents and Best Practices

7.What Changed in 2025

8.Common Mistakes to Avoid

9.FAQs

1. What is IRS Form 6765?

IRS Form 6765 is the official document used by businesses to figure and claim the Credit for Increasing Research Activities. This tax credit, often called the R&D tax credit, helps businesses reduce their tax liability based on qualifying research and development work.

In short, if your company is doing innovative work that involves experimentation, testing, or developing new or improved products, processes, or software, Form 6765 helps you apply for a federal tax credit.

2. Why Form 6765 Matters?

Ever feel like the IRS writes instructions in a secret language only accountants understand? You are not alone. But Form 6765 is worth the effort. R&D tax credits can significantly reduce taxes for small and large businesses alike when properly documented and claimed.

The Form 6765 Instructions guide you through eligibility, how to calculate the credit, and where to report each figure. Filling this form correctly prevents delays and minimizes audit risk.

3. Who Qualifies for the R D Tax Credit?

As a general rule, businesses that engage in qualified research activities can claim the R&D tax credit using Form 6765. Qualifying activities usually include:

- Developing new products or improving existing ones

- Performing controlled experiments to test new concepts

- Innovating processes, software, or production techniques

Who qualifies?

Broadly, companies of all sizes can qualify, but certain criteria must be met. Typically:

- There must be qualified research expenses (QREs) for the tax year

- The research must meet the IRS’s scientific and technological tests

- The work must be done within the United States or a U.S. territory

This means product design, software development, hardware improvement, lab testing, and many engineering tasks may count. Not sure? Reach out to a tax expert who can help you confirm eligibility.

4. Key Terms Explained

What are QREs?

Qualified Research Expenses (QREs) are the building blocks of the R&D credit. These include:

- Wages paid for qualified services

- Supplies used in research activities

- Contract research expenses paid to third parties

QREs must be documented and supported with timesheets, invoices, and clear expense reports. These will determine the size of your tax credit.

How to Calculate ASC vs Regular Method

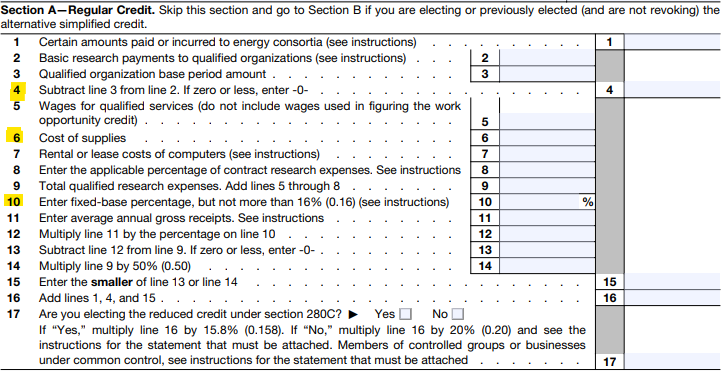

When completing Form 6765, you have two main ways to calculate your R&D tax credit:

- Regular Method – based on detailed calculations using current and past year expenses

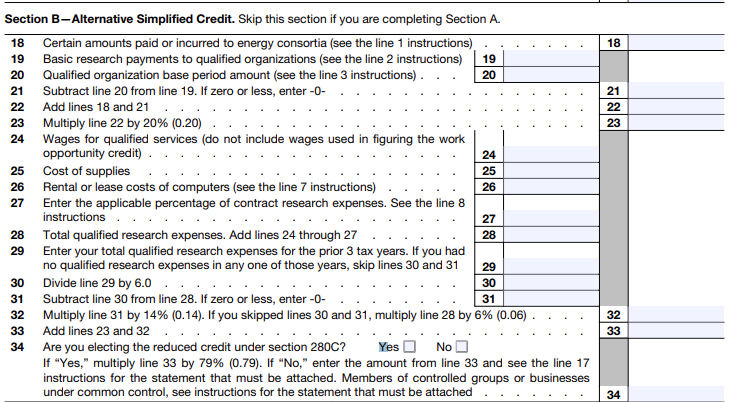

2.Alternative Simplified Credit (ASC) – a simpler percentage‑based approach

The ASC often benefits smaller businesses or those with irregular past expenses. You elect ASC in Section B of the form. The form’s instructions walk you through how to switch between these methods and determine which yields a higher credit amount.

Quick Note: A complete IRS form list helps you quickly find and access all tax forms needed for filing, reporting, and claiming credits efficiently.

5. Step‑by‑Step IRS Form 6765 Instructions

Let’s unpack the form the way the IRS expects you to. These are the core sections:

Section A: Section 280C Election

At the top of the form, you choose whether to make the Section 280C election. This affects the amount of credit you can claim and is irreversible for that tax year.

Section B: Alternative Simplified Credit

If you choose the ASC, complete this section instead of the regular credit section. This saves time but requires accurate calculation of QREs for past years.

Section C: Current Year Credit

Here you report the credit amount based on figures determined in Sections A or B, including adjustments and carryforward amounts.

Section D: Qualified Small Business Payroll Tax Election

If your business qualifies as a small business, you may elect to apply up to $500,000 of your R&D credit against payroll taxes instead of income tax. This is especially useful for startups with limited income but higher payroll expenses.

E, F, G: Additional Information

- Section E – additional info on QREs

- Section F – summary of all QREs

- Section G – detailed business component data (may be optional for tax year 2025)

Once completed, attach Form 6765 to your tax return before filing.

6. Required Documents and Best Practices

The IRS expects supporting documentation for every number you report. Important documents include:

- Payroll records showing qualified research wages

- Supplier invoices tied to research activities

- Contracts for research performed by third parties

- Timesheets that justify employee work allocation

Keeping these organized not only protects you during an audit but also speeds up credit approval. According to community discussions, having business component and wage support records is vital.

This is why partnering with a trusted provider like BooksMerge can save hours of frustration.

7. What Changed in 2025?

For the 2025 filing season, the IRS has updated instructions for Form 6765 to reflect improved clarity and reporting requirements. Major updates include:

- Revised naming conventions for attachments

- New sections (E, F, G) for better research expense reporting

- Optional status for Section G reporting for 2025 filings

- Clarified payroll tax credit election rules and limitations

These changes aim to standardize how research activities are reported while giving small businesses more flexibility during the transition period.

8. Common Mistakes to Avoid

Even seasoned accountants trip over a few common pitfalls:

- Forgetting payroll tax election deadlines – must be made with the original return

- Misclassifying QREs – only properly documented and eligible expenses count

- Mixing ASC and regular method improperly

- Failing to attach proper naming files when e‑filing

Using trusted guidance and double‑checking numbers helps prevent costly errors.

9. Frequently Asked Questions

1. What is Form 6765 used for?

Form 6765 is used by businesses to figure and claim the federal R&D tax credit and elect options like payroll tax credits.

2. Who qualifies for R&D tax credit?

Businesses conducting qualifying research that meets IRS scientific and testing standards with valid QREs may qualify.

3. What are QREs?

QREs include qualified wages, supplies, and contract research expenses that support your research credit.

4. How to calculate ASC vs regular method?

ASC simplifies calculation using historical QREs, while the regular method uses specific formulas. IRS instructions walk through both.

5. What documents are required?

Payroll records, supplier invoices, contract research documentation, and expense reports are required to support your figures.

6. Can startups use payroll offset?

Yes, qualified small businesses can elect to apply part of their R&D credit against payroll taxes up to $500,000.

7. What changed in 2025?

Section G reporting is optional for tax year 2025 and structural instructions were clarified.

Read Also: Form 6765 Instructions