Form 6765 instructions help businesses claim IRS R&D tax credits, track qualified research expenses, select the right calculation method, and file accurately to maximize federal tax benefits.

Table of Contents

- Introduction to Form 6765

- What Is Form 6765 Used For?

- Why R&D Tax Credits Matter in 2026

- Who Qualifies for R&D Tax Credit?

- Understanding Qualified Research Expenses (QREs)

- Step-by-Step Instructions for Form 6765

- Regular vs ASC Method

- How to Calculate ASC vs Regular Method

- Can Startups Use Payroll Offset?

- Documents Required for Form 6765

- Form 6765 Instructions 2025 vs 2026 Updates

- Common Filing Mistakes to Avoid

- How Accurate Filing Builds IRS Trust

- Booksmerge Insights on Form 6765

- Conclusion

- FAQs

Introduction to Form 6765

Innovation is expensive. Developing new products, improving processes, or experimenting with technology can drain resources. Thankfully, the IRS provides Form 6765 to help businesses recoup some of these costs through the R&D tax credit.

Despite its benefits, many businesses leave money on the table because they find IRS Form 6765 instructions confusing or overwhelming. This guide, backed by Booksmerge, helps companies navigate the process, ensuring compliance and maximizing credits.

What Is Form 6765 Used For?

Form 6765 is designed to claim the federal R&D tax credit. Businesses use it to:

- Reduce federal income tax liability

- Offset payroll taxes for eligible startups

- Recover costs for developing or improving products, processes, or software

Even projects that do not succeed may qualify if they involve systematic experimentation. This encourages innovation while providing tangible financial relief.

Why R&D Tax Credits Matter in 2026?

R&D tax credits remain one of the most underused incentives. Properly claiming them provides:

- Improved cash flow: Reduces taxes owed, freeing capital for growth

- Financial support for innovation: Funds ongoing research and development

- Tax compliance advantage: Following IRS instructions reduces audit risk

In 2026, the IRS emphasizes detailed documentation and project-level tracking. Businesses that follow instructions for Form 6765 maximize credits while staying fully compliant.

Who Qualifies for R&D Tax Credit?

You don’t have to be a Fortune 500 company. Many businesses qualify, including:

- Software developers and tech firms

- Manufacturers improving production processes

- Biotech and life sciences companies

- Engineering and architecture businesses

The IRS applies a four-part test:

- Permitted purpose: Improving a product, process, or performance

- Eliminating uncertainty: Tackling technical or scientific challenges

- Process of experimentation: Prototyping, testing, and refining

- Technological in nature: Based on engineering or scientific principles

If your business conducts systematic research, you likely qualify.

Understanding Qualified Research Expenses (QREs)

QREs are the core of any R&D tax credit claim. Without them, you cannot claim a credit.

Common QREs include:

- Employee wages directly involved in research

- Supplies used in R&D projects

- Contract research expenses (typically 65% of payments)

Non-qualifying expenses include administrative work, marketing, and routine training. Proper classification ensures compliance and reduces audit risk.

Quick Note: Filling out a 1040 form reports your annual income, deductions, and taxes to the IRS, ensuring accurate tax filing and avoiding penalties.

Step-by-Step Instructions for Form 6765

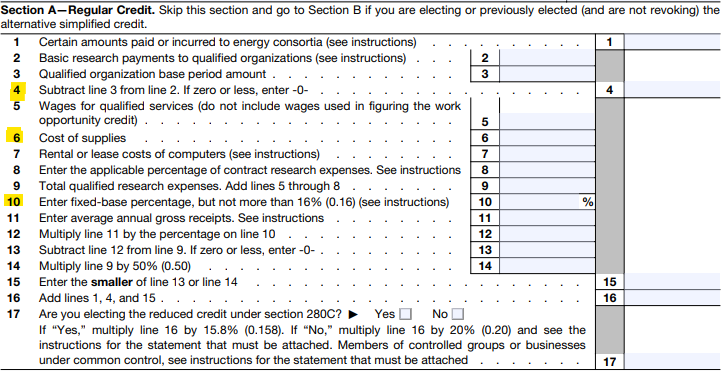

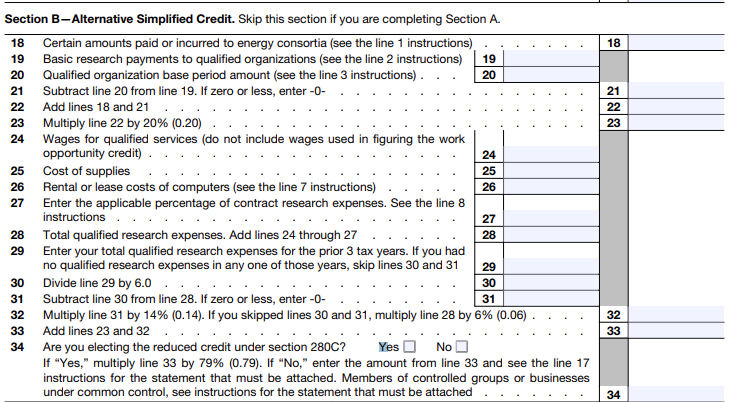

Form 6765 has four main sections:

- Part I – Regular Credit: Uses historical base period data for long-established businesses

- Part II – Alternative Simplified Credit (ASC): Easier calculation with fewer historical records

- Part III – Coordination with Other Credits: Ensures credits are not double-counted

- Part IV – Payroll Tax Offset: Lets eligible startups apply credits against payroll taxes

Following these steps carefully ensures accurate filing and maximizes your credit.

Regular vs ASC Method

Businesses can choose between:

- Regular Method: Uses historical R&D spending; suitable for long-established firms

- ASC Method: Uses a three-year rolling average; simpler for small businesses and startups

The ASC method is often preferred due to its simplicity and reduced audit risk.

How to Calculate ASC vs Regular Method

- ASC Method: Credit = 14% of QREs exceeding 50% of the prior three-year average

- Regular Method: Requires historical QRE and gross receipts data to calculate a fixed base percentage

Selecting the correct method ensures accurate calculations and maximizes the credit.

Can Startups Use Payroll Offset?

Yes. Eligible small businesses can apply up to $500,000 of R&D credits against payroll taxes.

Eligibility requirements:

- Gross receipts under $5 million

- No gross receipts prior to the five-year window

This feature helps startups preserve cash flow while funding innovation.

Documents Required for Form 6765

Proper documentation is essential for compliance. Required records include:

- Payroll reports and W-2 summaries

- Time-tracking for R&D projects

- Expense ledgers for supplies and contract research

- Detailed project descriptions and logs

Well-organized records reduce audit risk. For financial literacy insights, check:

Form 6765 Instructions 2025 vs 2026 Updates

The form structure remains mostly the same, but 2026 emphasizes:

- Project-level documentation

- Direct linkage of expenses to research activities

- Detailed reporting for software and technical projects

Following these updates ensures compliance and accurate filing.

Common Filing Mistakes to Avoid

Avoid these errors:

- Including non-R&D wages

- Vague project descriptions

- Unsupported expense claims

- Missing contemporaneous documentation

Accuracy and clarity reduce audit risk and ensure maximum credit.

How Accurate Filing Builds IRS Trust?

Accurate filing builds credibility with the IRS and investors:

- Reduces audit risk

- Improves long-term tax planning

- Increases business credibility

Consistency demonstrates professionalism and reliability.

Booksmerge Insights on Form 6765

Booksmerge offers expert guidance on IRS Form 6765 instructions:

- Identifying and classifying QREs correctly

- Choosing the optimal calculation method (ASC vs Regular)

- Preparing detailed, compliant documentation

- Maximizing payroll offsets

Call +1-866-513-4656 for expert help to claim your R&D tax credits safely and efficiently.

Conclusion

Form 6765 is a powerful tool for businesses in 2026. Accurate filing, thorough documentation, and selecting the right method ensure your R&D tax credit is claimed fully and safely.

Following IRS Form 6765 instructions guarantees every eligible dollar is recovered, supporting ongoing innovation and growth.

Frequently Asked Questions

What is Form 6765 used for?

Form 6765 allows businesses to claim federal R&D tax credits for qualified research activities.

Who qualifies for R&D tax credit?

Companies conducting systematic research or product/process improvement generally qualify.

What are QREs?

Qualified Research Expenses include wages, supplies, and contract research linked to R&D activities.

How to calculate ASC vs regular method?

ASC uses a three-year rolling average; Regular method uses historical base period data.

What documents are required?

Payroll reports, project logs, expense ledgers, and detailed technical documentation.

Can startups use payroll offset?

Yes, eligible small businesses can offset up to $500,000 against payroll taxes.

What changed in 2025?

The IRS emphasized project-level documentation and direct expense linkage, which continues into 2026.

Read Also: Form 6765 Instructions

For professional assistance with IRS Form 6765 instructions, call Booksmerge at +1-866-513-4656 to maximize your R&D tax credit claims accurately and compliantly.